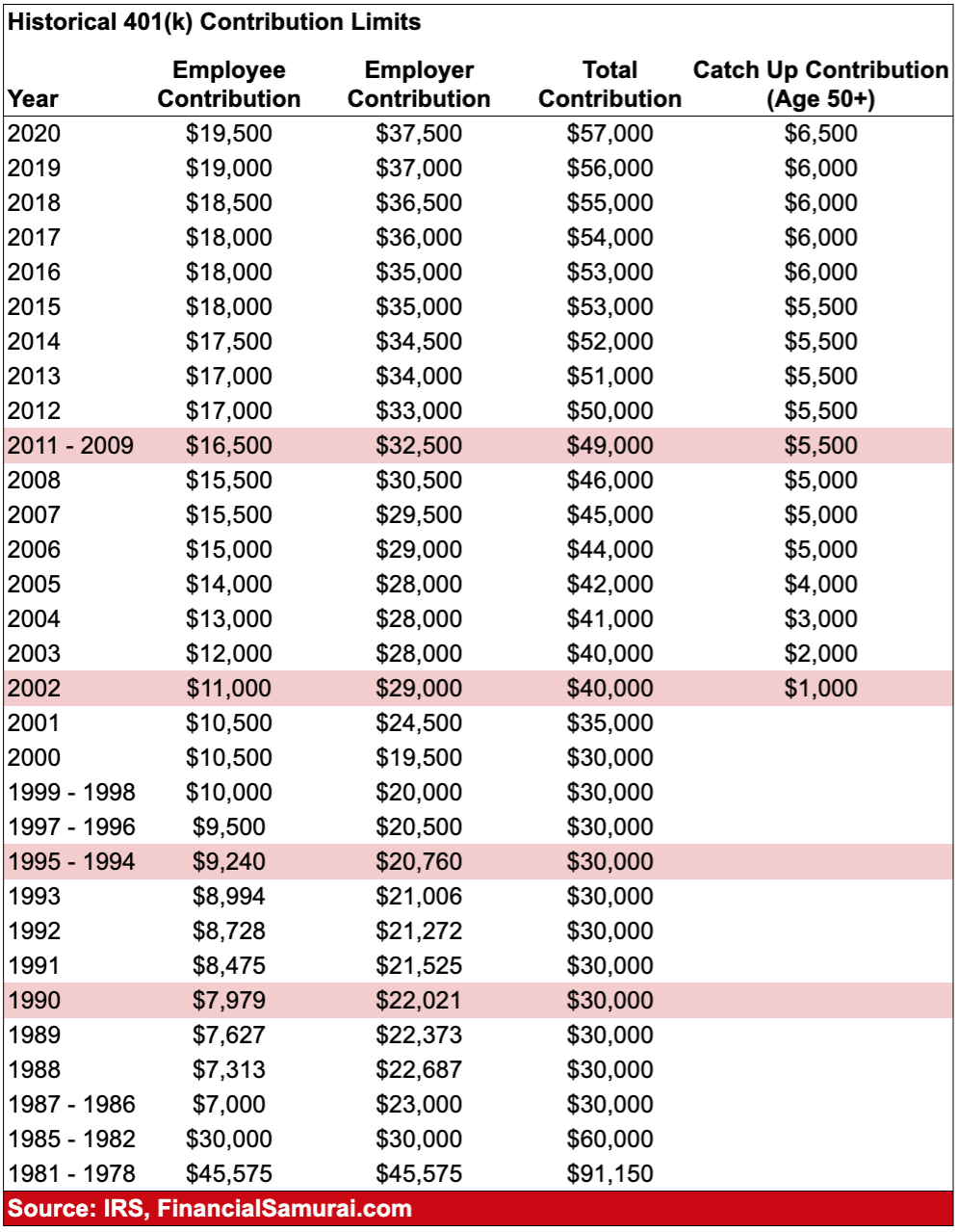

2025 401k Max Catch Up Period. For 2025, the maximum you can contribute to a simple 401 (k) is $16,000. For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025. For 2025, the maximum you can contribute to a simple 401 (k) is $16,000.

401k Max 2025 Catch Up Eada Rhodie, The limit on employer and employee contributions is $69,000.

Maximum 401k Contribution 2025 With Catch Up Gael Sallyann, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

401k Contribution Limits 2025 Catch Up Total Assets Risa Verile, For 2025, the maximum you can contribute to a simple 401 (k) is $16,000.

2025 401k Catch Up Contribution Amounts By State Anne Maisie, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

2025 401k Max Catch Up Tova Ainsley, Employees can contribute up to $22,500, up from $22,000 in 2025.

401k Maximum Contribution 2025 Plus Catch Up Provision Kim Gabriell, Savers will be able to contribute as much as $23,000 in 2025 to a 401(k), up from $22,500 in 2025, an increase of $500 from 2025.

Catch Up Amount For 401k 2025 Kara Theodora, The contribution limit for simple 401(k)s is $16,000 (up to $19,500 if.